Invoice Price vs List Price: Key Differences Explained

- 24 Nov 25

- 9 mins

Invoice Price vs List Price: Key Differences Explained

Key Takeaways

- Understanding invoice price vs list price helps businesses build stronger pricing and profit strategies.

- Invoice price reflects the negotiated amount paid by retailers, while list price sets the customer-facing value benchmark.

- The invoice price vs list price gap is crucial for calculating margins and planning discounts.

- Accurate invoice price supports compliance, cash-flow stability and informed purchasing.

- Comparing invoice price vs list price enables smarter market positioning and transparent pricing.

Trying to get a clear picture of invoice price vs list price? It is an essential topic to understand if your business aims to maintain higher profit margins, build pricing strategies and be transparent.

While the invoice price represents the amount a retailer or distributor pays after discounts and negotiations, the list price serves as the standard rate displayed to customers, setting a benchmark for perceived value.

Let us explore 8 differences between invoice price and list price with additional focus on each pricing element.

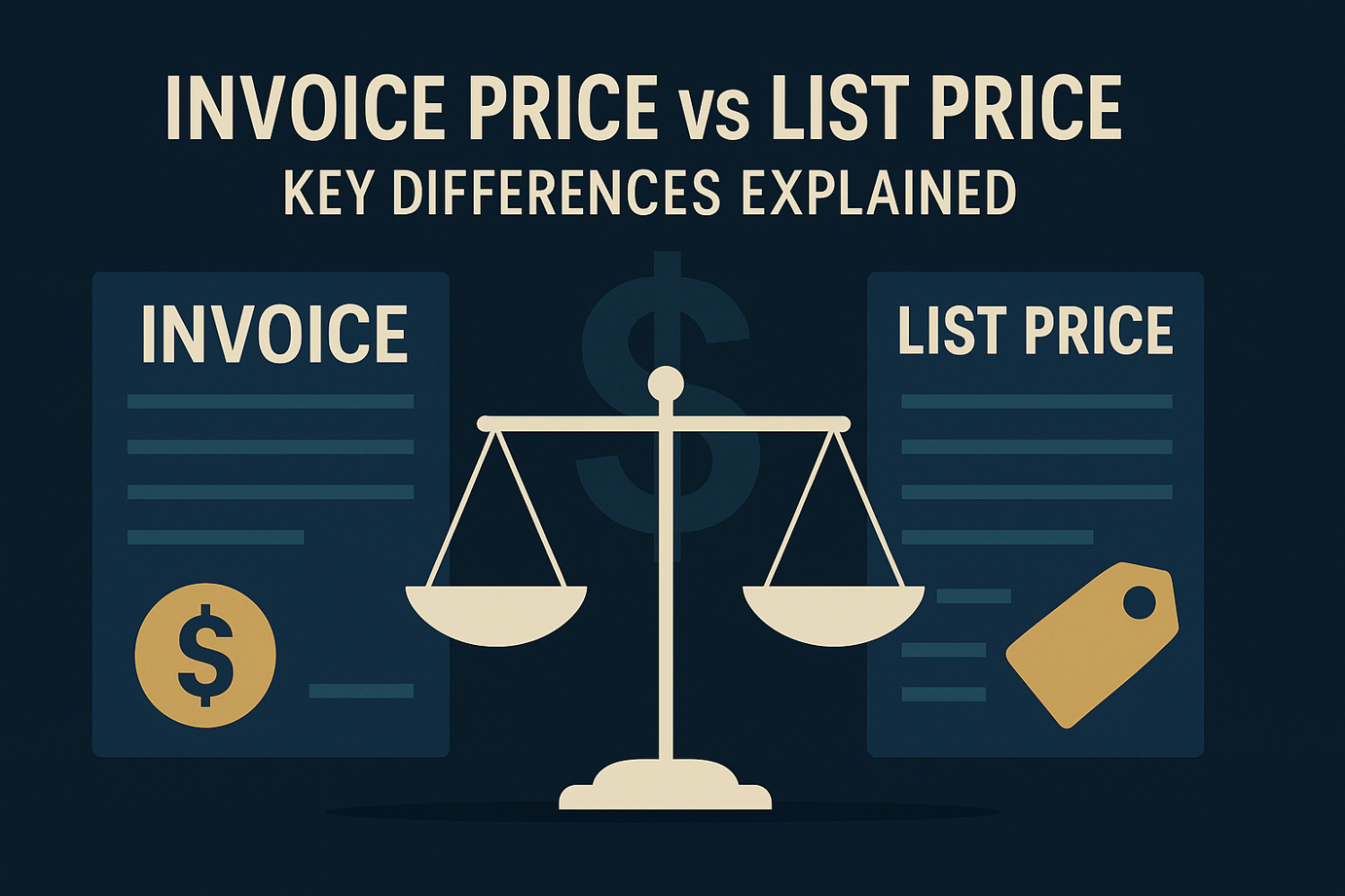

8 Key Differences Between Invoice Price vs List Price

In India’s competitive retail market, knowing invoice and list prices helps businesses price smartly. Retailers generally buy at invoice price, then sell below list price, earning profit through the markup (selling price) in between.

Find in the table below 8 key invoice price vs list price differences:

| Factors | Invoice Price | List Price |

| Purpose | The invoice price helps in accounting and transaction recording. | List price influences perception and sets value expectations. |

| Who Pays | The dealer (retailer) pays the invoice price. | The consumer potentially pays the list price. |

| Transparency | The invoice price may not always be readily available to the consumer. | The list price is typically displayed to the end customer. |

| Negotiability | Businesses can negotiate the invoice price based on volume, offers or relationships. | Businesses usually fix the list price as a standard reference across the market. |

| Pricing Origin | Companies calculate the invoice price after negotiation, discounts and order-specific terms. | Companies define the list price before any sales pricing, as a reference point or default value. |

| Use | Businesses use invoice prices for billing, payment collection and accounting. | They use list prices to position products in the market and attract buyer attention. |

| Profit Margin | Invoice prices are actually way lower than the list price in case of profits. | They are higher than the invoice price, even after businesses give a discount on these prices. |

| Strategy | Invoice price reflects the tactical and transactional side of pricing. | List price supports strategic planning and long-term market positioning. |

Note: If an end customer is directly purchasing the product from the manufacturer or the wholesaler, then they pay the invoice price.

What is Invoice Price?

Invoice price refers to the amount a wholesale distributor or manufacturer charges, and or a retailer pays for a service or product. It represents the amount of money that the distributor or manufacturer charges as per the invoice for the goods or services which they deliver. The invoice price helps determine the lowest possible sales price and understand how much you might be able to reduce from your purchase cost.

Let’s Understand Invoice Price with an Example

Imagine you are a bike dealer and you have placed an order with a manufacturer for 10 bikes. This manufacturer provides you with an invoice price of ₹10,00,000 per bike.

Since you made a bulk purchase from this manufacturer, you negotiate for a 5% discount on the invoice price of each bike. After this negotiation process, you get a total discount of ₹50,000 per bike.

However, ₹10,00,000 per bike will be the original price that your invoice will have. This will allow you to keep a record of your purchases’ base price.

This record will be true despite you paying a discounted price of ₹9,50,000 per bike. Thus, the manufacturer will get a final payment of ₹95,00,000, which is calculated on the basis of the discounted price.

On the other hand, your invoice will show the point of reference of the original agreement.

Importance of Accurate Invoice Price

While we are at it, you must note that the invoice price is not the same as the cost price. It does not reflect the actual cost of making the product. Still, it plays a key role in helping retailers figure out their profit margins.

Apart from this, here are some other points highlighting the importance of accurate invoice price:

- Enhances Financial Clarity

Nearly half (48%) of all businesses depend on invoices to collect financial data. They use this data for internal analysis and reporting.

Therefore, if these invoices show correct pricing data and maintain a clean record of all the past transactions, it will support informed purchasing decisions for the company in future.

On the other hand, if the company has inaccurate price in data, it can lead to decisions that might negatively impact the company’s ability to perform predictive analysis. Therefore, being aware of the invoice price enables you to negotiate a fair price that works well for both parties.

- Boost in Efficiency of Cash Flow

By managing invoice prices in an optimised manner, a business can ensure budget maintenance.

This, in return, enables the business to make timely payments and have a positive impact on its cash flow.

Inaccurate invoices can lead to payment delays and destruction in cash flow management by negatively impacting the company’s budget. It can also lead to the disruption of the company’s financial stability.

- Maintains Regulatory Compliance

In India, companies are required to follow set invoicing standards and legal guidelines. For instance, the Invoice Registration Portal (IRP) will no longer distinguish between uppercase and lowercase letters in invoice or document numbers during IRN generation, starting from June 2025.

Therefore, issuing a correct price on the invoice keeps the business compliant and also helps them avoid any kind of legal troubles and fines.

For instance, if a business in India issues an incorrect tax invoice, authorities can impose a penalty of ₹25,000. Additionally, failing to generate a mandatory e-invoice may attract a fine of ₹10,000 or 100% of the tax due, whichever amount is greater.

Additionally, it is also an essential factor for a business to maintain accuracy in invoices for passing audit checks from the Indian tax authorities.

💡For tracking business transactions and invoice generation, use the PICE App.

What Is List Price?

List price, also known as retail price (MSRP) or sticker price, refers to the standard price that a supplier or manufacturer sets for their services or products without applying any discounts or entering any negotiations. Businesses use it as a starting point during price discussions and as a benchmark for comparing different suppliers. Many industries rely on list pricing to structure their business-to-business (B2B) transactions.

For instance, the price displayed on the box of a new phone or laptop is its list price.

Key Benefits of List Pricing

When setting list prices, sellers need to strike the right balance. If the list price is too high, customers may walk away or if it is too low, the profits may take a hit.

Here are 4 primary benefits of setting the right list price:

- Enable Price Differentiation and Optimisation

By setting list prices, you can establish a reference point that supports both price differentiation and optimisation strategies. This will help in benefiting your business by providing a reference price. Thus, guiding discounting decisions and setting the foundation for segment-based pricing.

- Reinforce the Value of Your Offerings

When you implement list pricing, you reinforce the value of your products or services. It enables you to differentiate your offerings and strategically position them against competitors.

For instance, two plumbers in an area provide the same services. However, plumber A charges ₹500 for a fitting procedure and plumber B charges ₹200 for the same. Plumber A will automatically be considered more favourably by the customers and be associated with a higher quality of work.

List pricing strategies work similarly to strategically position a product or a service against competitors.

- Promote Consistent Pricing Across Channels

By relying on list prices, you ensure pricing consistency across multiple sales channels. Distributors and partners can refer to these standard prices to better understand margins and profitability.

When you operate across different countries or markets, list prices serve as a stable reference that helps balance local pricing accuracy with the risk of grey market interference.

- Simplify and Streamline Price Optimisation

Finally, you also make the price optimisation process more efficient by using well-defined list prices. Whether your team negotiates custom deals or adjusts pricing for broader customer segments, list prices give a clear baseline that helps improve profitability across transactions.

3 Different Methods for Setting List Prices

- Competitive Pricing

In this method, businesses analyse the prices set by competitors and align their own pricing strategy accordingly.

Businesses entering a new market benefit from this approach when they lack an established brand or reputation and need to stay competitive to attract customers.

- Cost-Based Pricing

Companies often calculate the cost of producing or delivering a product or service, then add a markup to set the list price.

This markup helps cover expenses such as R&D, marketing, overheads and ensures a desired profit margin.

- Value-Based Pricing

Businesses also set prices on the basis of the perceived value of their products or services that they offer to their customers.

Therefore, instead of focusing solely on costs or competitors, they assess how much their customers are willing to pay. This willingness is judged on the basis of the product’s market value and the benefits it offers.

Apart from invoice and list pricing, you may also come across other pricing terms such as wholesale price, destination charge and out-the-door price. Among these, the final contract price is the most crucial figure to focus on during the purchase.

Conclusion

The invoice price vs list price comparison reveals a clear division between operational execution and strategic branding. The invoice price functions as a tactical tool focused on negotiations and accurate account keeping.

On the other hand, the list price plays a crucial role in impacting customer perception and market competitiveness. If a business gets clarity on the difference between invoice price and list price, it can make smarter decisions and achieve long-term profitability.

By

By